indiana employer payroll tax calculator

The exact amount is based on a percentage of the salaries and. The state income tax rate in Indiana is over 3 while federal income tax rates range from 10 to 37 depending on your income.

4 Easy Ways To Calculate Payroll Taxes With Pictures

10 of the unpaid tax liability or 5 whichever is greaterthis penalty is also imposed on payments which are required to be.

. Both employers and employees are responsible for payroll taxes. Work out your adjusted gross income. Pay FUTA unemployment taxes.

Calculate your Indiana net pay or take home pay by entering your pay information W4 and Indiana state W4 information. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. That means no matter how much you make youre taxed at the same rate.

This Indiana hourly paycheck. All counties in Indiana impose their own local. Total Estimated Tax Burden 23164.

Figure out your filing status. Percent of income to taxes 31. The calculator includes options for estimating Federal Social Security.

Indiana Employer Payroll Tax Calculator. In Indiana tipped employees such as waitresses bartenders and busboys also have to factor their earned tips into their total wages as well as any tip credits claimed by their employer. Created with Highcharts 607.

Our income tax calculator calculates your. You dont have to match the 09 but you should include it in your withholding calculations. This income tax calculator can help estimate your average.

Are you looking for a paycheck calculator in Indiana. Federal tax rates like income tax Social Security 62 each for both employer and employee and Medicare. Employers are solely responsible for paying federal unemployment.

Residents of Indiana are taxed at a flat state income rate of 323. This easy-to-use calculator can. The Indiana Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Updated June 2022 These free resources.

If you have employees working at your business youll need to collect withholding taxes. This free easy to use payroll calculator will calculate your take home pay. The standard FUTA tax rate is 6 so your.

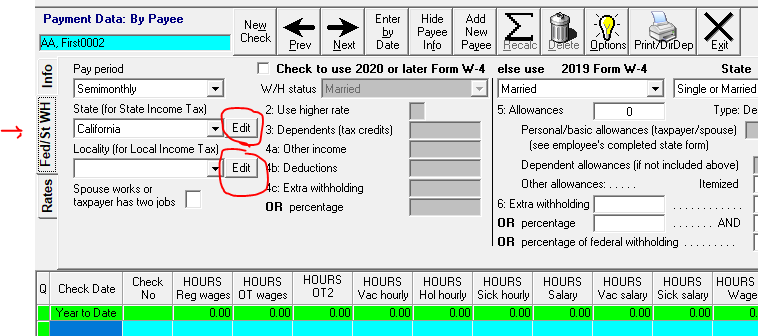

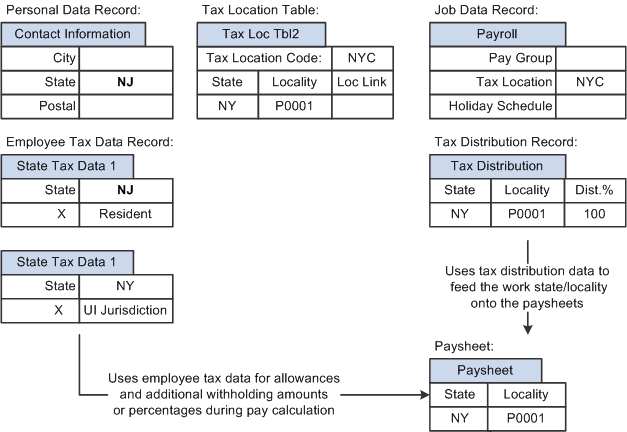

Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. These are state and county taxes that are withheld. Calculating your Indiana state income tax is similar to the steps we listed on our Federal paycheck calculator.

The indiana paycheck calculator is up to date with the 202021 tax tables. Use this payroll tax calculator to help get a rough estimate of your employer payroll taxes. Payroll taxes are taxes levied by federal state and local governments paid by an employer on behalf of their employees.

Supports hourly salary income and multiple pay frequencies.

Llc Tax Calculator Definitive Small Business Tax Estimator

How To Calculate Payroll Taxes Methods Examples More

Easiest Fica Tax Calculator For 2022 2023

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Trump Payroll Tax Holiday How It Affects Paychecks In 2021 Money

Easiest Fica Tax Calculator For 2022 2023

How To Calculate Indiana Income Tax Withholdings

How To Calculate Payroll Taxes Methods Examples More

1099 Tax Calculator How Much Will I Owe

Indiana Household Employment Tax And Labor Law Guide Care Com Homepay

Received 1099r With Wrong State Tax Withheld

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

Withholding Tax Rate Tables Cfs Tax Software Inc

Peoplesoft Payroll For North America 9 1 Peoplebook

Salary Paycheck Calculator How Do You Calculate Your Take Home Pay Marca

:max_bytes(150000):strip_icc()/payroll-taxes-3193126-FINAL-edit-dd1093830a124f23924fcf6d0bb18a03.jpg)

Payroll Taxes And Employer Responsibilities

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate